The Canadian retail landscape is poised for change in the year ahead as consumer behaviour and spending patterns will test retailers and push for innovation as they compete to remain top of mind for shoppers, according to a new report by real estate firm CBRE.

Churn is expected but should be a boon for the sector which has seen limited vacancy amongst the most in-demand formats, added the 2024 Canada Real Estate Market Outlook.

The report identified three trends to watch:

- Changing consumer behaviour and spending patterns are expected to challenge retailers in the year ahead. Capturing and maintaining consumer attention will be of importance for brands;

- Retail insolvency filings are on the rise; however, these promise to promote growth by opening opportunities in markets where vacancy has been limited. Consolidation, rollup, and acquisition will likely be seen among established brands propelling these institutions to grow and reach new highs in 2024;

- Companies will continue to implement technologies such as AI as part of building their competitive edge. It remains important however that these advancements, both online and in-store, are thoughtful and effective in improving the customer experience.

“Inflation and elevated interest rates constrained wallets in 2023 and led to a gradual consumer pullback in the latter half of the year. This rebalancing period is expected to continue in 2024 with Oxford Economics forecasting retail sales to decline year- over-year by -0.6%. Ultimately this will put capturing and maintaining consumer attention into sharper focus for brands in the year ahead with 64% of respondents in Salesforce’s State of Commerce survey indicated that meeting customer expectations is harder than ever,” said the CBRE report.

“Consumer behaviours started to shift amidst the peak of inflation in 2023 as shoppers became more critical of their discretionary spending and household budgets. Value in particular has had a boom with sales growth at brands that offer savings. Continuing from 2023, consumers will try to save money on essential items in 2024 by trading down to value channels and products, especially for grocery items where inflation has been most acutely felt. This is both to reduce spending and allow consumers the ability to trade up or spend more on less essential items, including luxury goods or other micro indulgencies.

“All that said, 2024 promises to challenge retailers. Expect retailers to lean into discounts or other targeted promotions to capture the selective spending and move product. Expansion and innovation will be greatest among those facing headwinds or that are carving a niche for themselves within the Canadian marketplace.”

CBRE said elevated interest rates are having a material impact on business operations.

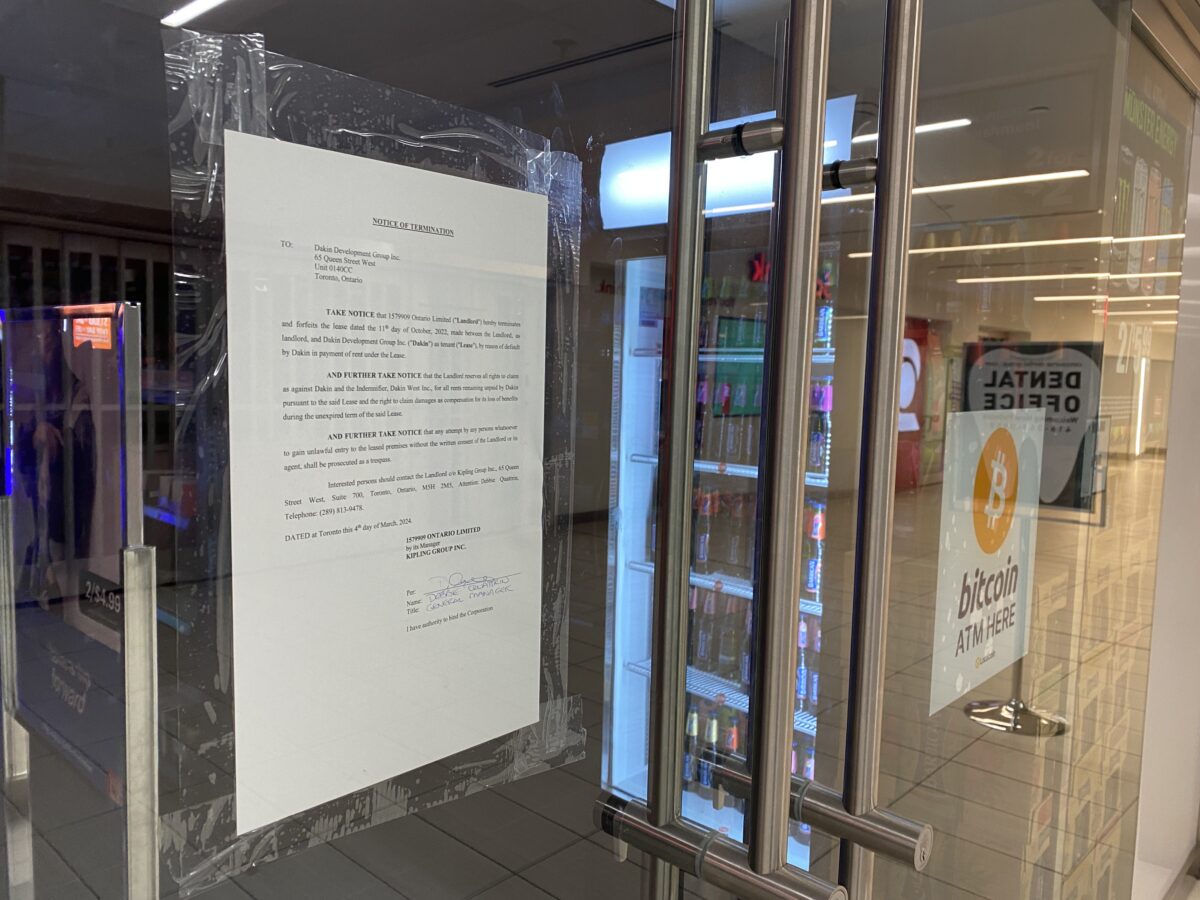

“Coupled with a cost-of-living crisis and pullback in consumer spending, business insolvency filings started to creep up across the country in 2023, increasing over 40% from the prior year. The Federal government deadline to pay back pandemic loans happened in early 2024, the impact of which will be most acutely felt among small businesses, with many speculating we will see more churn in the industry in the year ahead,” said the report.

“Consolidation, rollup, and acquisition will likely be seen among established brands propelling these institutions to grow and reach new highs in 2024. We started to see some of these moves take shape in 2023 including Putman Investments taking on a portion of the former Bed Bath & Beyond portfolio; as well as Unity Brands acquiring Kit + Ace and Mastermind Toys. In each of these cases, the originating brand needed some form of repositioning, either having been stagnant or by growing too quickly.

‘From a real estate perspective, this churn can be viewed as a good thing as it brings the potential to open opportunities in markets where vacancy has been limited. Looking at REIT-owned property performance, retail vacancy trended down over 2023 to 4.0% with all but regional shopping centres showing a marked improvement. Good real estate has and will continue to be leased quickly, resulting in limited vacancy amongst the most in-demand formats, namely grocery-anchored centres. Because of this, tight market conditions are expected to persist, especially when paired with a softening supply pipeline, a byproduct of higher construction costs.”

CBRE said 78% of Canadians expressed security concerns with personal data related to AI. The report added that retailers need to balance convenience and security while building trust in this sphere.

“CBRE’s Global Live-Work- Shop Report found that Canadians prefer to shop in-person across all categories, a fact that should not be forgotten. Part of the competitive edge that companies will be seeking in the year ahead involves implementing technologies such as Artificial Intelligence (AI), especially as it aids in improving the customer experience through personalized recommendations and product discovery. AI technologies and solutions will drive innovation, improve the shopper journey, deepen loyalty, and elevate the overall brand,” explained the report.

“As with any type of change however comes a learning curve before being widely adopted. SOTI’s Techspectations: Consumer Demand for Digital Transformation in Retail report found that there are still some pain points to both new and existing technologies being implemented. Namely, 78% of Canadians expressed security concerns with personal data related to AI. Retailers need to balance convenience and security while building trust in this sphere.

“The technology learning curve can also extend to the physical store as we’ve seen a rapid adoption of self-checkout stations or sales professionals carrying around tablets that check store inventory. According to SOTI, 43% of customers indicated that these technologies can enhance shopping convenience and speed; however technology can also complicate the shopping experience with 28% of respondents finding making in-store purchases more confusing.

“It will be important in the year ahead that the technologies being implemented in-store are thoughtful and effective to the customer experience. CBRE’s Global Live-Work-Shop Report found that Canadians prefer to shop in-person across all categories, a fact that should not be forgotten. Consumers are eager to engage in more lively, personalized shopping experiences that cannot be offered online.”

Arlin Markowitz, Executive Vice President at CBRE’s Urban Retail Team, said some change is happening for consumers in terms of how much one’s disposable income people are willing to put into food and beverage, travel and entertainment.

“I’m seeing as an increase compared to years past, especially when you compare it to generations past,” he said.

“The consumer is not willing to sacrifice their lifestyle.”

Markowitz said retail spending has been steady which has been a surprise to many as interest rates have risen.

“We thought we would see the retail consumer tightening up the purse string and making sure they can pay their mortgage. Somehow it seems to me especially to me in the top urban markets in the country that the consumer has figured out a way to just keep on spending and spending on retail and not sacrificing lifestyle even if there was a ‘potential’ recession or if they’re feeling the squeeze on interest rates,” he said. “It just seems they’re not willing to sacrifice their retail habits.

“Generally speaking, it’s feeling really positive out there. It feels good for retail to be kind of the darling asset class when compared to office and development these days which are having a little bit of a harder time. We’ve been fortunate to benefit and witness retail’s resiliency through COVID. It came out strong. Now it’s performing really well. It’s just great to see. I think people will just continue to crave the kind authentic in-person experience shopping in stores. And I don’t think online hurt retail the way people thought it might in the early 2000s. Everything has kind of settled down into a nice pattern and retail appears really strong in 2024 even surprisingly so to myself. It’s a pleasant surprise I would say.”