A new research study finds that only 20% of retailers are investing optimally in their future growth. This is concerning, considering unprecedented competition from pure play e-tailers, new international entrants, and expanding discount chains. We interviewed the retail expert who interviewed top executives at 20 chain retailers for this study, to gain insight into what retailers in Canada and the United States are doing to effectively allocate capital to the right combination of growth strategy initiatives, as well as what can be improved.

The study, which was conducted by leading retail consultancy HRC Advisory, found that 80% of retailers surveyed lacked the right combination of growth strategies including new stores, e-commerce, m-commerce, omni-channel, and remodelling existing stores. The study found that only 10% of retailers prioritized remodelling and refreshing existing locations, while the majority focused on opening new stores. The study also found that the same 80% of retailers lacked clarity on the return-on-investment surrounding e-commerce and omni-channel investment initiatives, and that only about 20% of retailers surveyed planned to expand internationally.

In the survey, the 20% of retailers that are ‘getting it right’ are effectively balancing capital spending across channels, not to mention sharply increasing their total capital spending in 2015/2016 to fund their growth and operating strategies. As a result, this group is able to most effectively connect their brick-and-mortar stores, e-commerce and fulfillment centres as well as adding new stores and remodelling their flagships and other key store locations. The same study found that the remaining 80% of retailers are spending approximately the same amount of capital as in prior years, primarily using internally-generated cash flow as the source of capital.

According to HRC Advisory CEO Antony Karabus “2015/2016 is the high-water mark in total capital spending for the 20% of retailers that are getting the balance of capital spending right,” and that “Disciplined capital allocation is one of the most important ways in which a CEO and CFO can influence a retail chain’s profitable growth. Striking the right balance between the key strategies to optimize the growth trajectories of a retailer’s online and brick and mortar assets is crucial”. Mr. Karabus then went on to describe that his findings included “evidence that only the 20% of surveyed retailers with strong balance sheets and access to capital are comprehensively investing in all of the key e-commerce and omni-channel capabilities, adding new stores and remodelling the top stores in their existing store fleets – all of which are necessary to transform retailers to reflect today’s increasingly digital shopping environment. As a result, these retailers are positioned for an even stronger future as they are investing to provide the consumer with a more consistent, upgraded experience across all interactions in all channels.”

Mr Karabus interviewed the CEOs and CFOs of 20 chain retailers for this HRC Study in the specialty sector (70%, including apparel, accessories, home and footwear), department store sector (15%) and discount sectors (15%). The study was conducted in the spring/summer of 2015, adding to previous retail research studies conducted by Mr. Karabus between 2008 and 2011. About 60% of the participating retailers were private and 40% public.

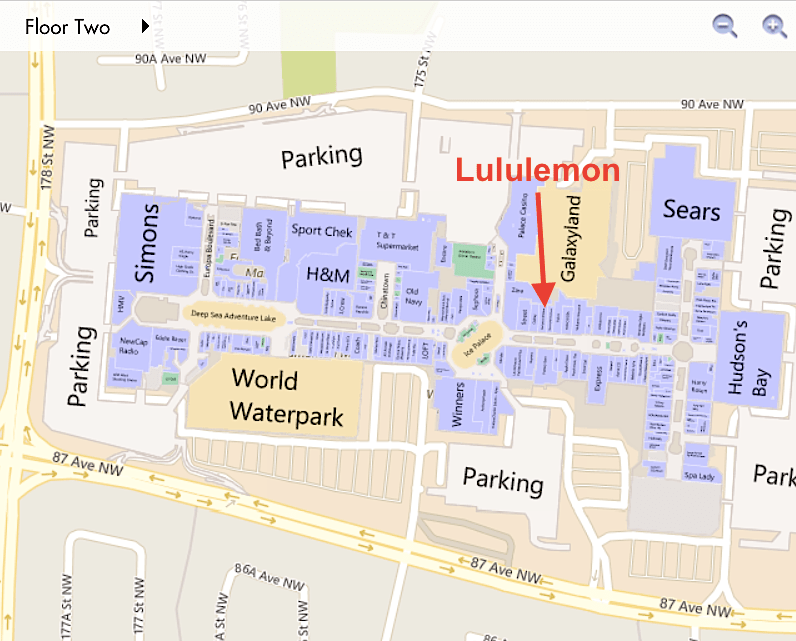

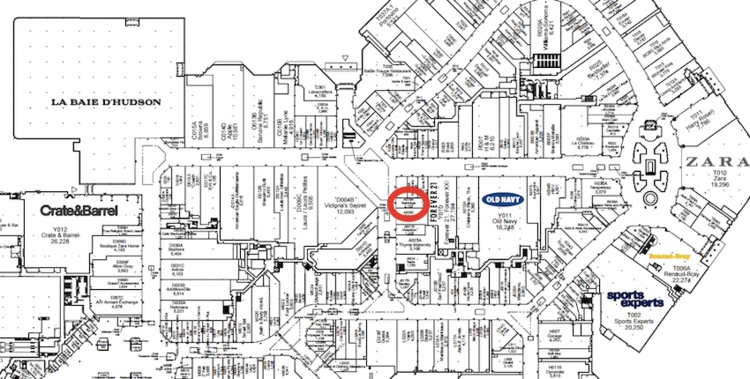

To gain clarity and to find Canadian examples, we interviewed Antony Karabus about HRC Advisory’s study. Mr. Karabus described how a number of retailers doing business in Canada are optimally investing in their brick-and-mortar operations, as well as online and omni-channel initiatives. Mr. Karabus discussed Canadian Tire’s new South Edmonton Common prototype store, which features technology innovations such as a driving simulator to test tires, and a virtual deck to plan patios. Under the same corporate umbrella, Sport Chek’s West Edmonton Mall flagship prototype, also technology-heavy, was reported by Retail Insider to have experienced tremendous sales increases relative to its previous mall location. Mr. Karabus also discussed remodelling of Canadian luxury retail stores, providing examples of Holt Renfrew’s upgraded Yorkdale Shopping Centre location, and how its bright interiors and personal shopping suites keep consumers engaged. Further, Mr. Karabus noted that Harry Rosen’s stunning store remodels are a very good examples of effective capital cost allotment, particularly as shoppers continue to shop in physical stores and to provide effective differentiation strategies relative to the e-commerce retailers selling better mens wear.

Indigo has done an exceptional job in the transformation of its business, according to Mr. Karabus, from a bookstore to what it describes as a “cultural department store”. The general merchandise categories are an well curated assortment of both proprietary and branded product that complements its dominant book business well. The remodelling of its Yorkdale (and other selected locations) store to add the dedicated Lego and American Girl shop-in-stores are exceptional and can be argued to have “changed the game” relative to other traditional bookstores,” he said.

Although many Canadian retailers were late to the e-commerce game, Mr. Karabus noted that it’s not necessarily a bad thing. Although some retailers may have to play ‘catch up’ in an attempt to gain market share online, these same retailers didn’t need to incur costs and time investment required by early-adopters, many who learned through inefficient trial and error.

For more on this study, please see the following links via the HRC Advisory website:

Study: Omnichannel Key to Success [Women’s Wear Daily]

HRC Advisory Study Finds 80 % of Retailers Have No International Expansion Plans [Sourcing Journal]

Study: Retail Industry a Bit Stumped on Growth Strategies [Retail Dive]

HRC Advisory: Retailers Must Reconsider Digital Age Investments [HomeWorld Business]

Q&A with HRC Advisory CEO Antony Karabus: Many Retailers Underestimate Importance of Remodels [Chain Store Age]

HRC Advisory Study: Retail Industry Divided on Growth Strategies, Capital Spend [Chain Store Age]