Canadian department store retailers are increasingly adding restaurants, coffee shops and other food and beverage/alcohol spaces to their stores. The trend can be good for business, according to one retail expert.

Although restaurants were once common in downtown Canadian department stores, the flight to the suburbs resulted in fewer in-store restaurants in newer mall-based locations. Many of Hudson’s Bay‘s current locations, for example, lack fine dining options, resulting in these stores becoming pure shopping destinations. Although Hudson’s Bay recently introduced some exceptional food options to its downtown flagships, most suburban locations continue to lack prepared food and drink options. Sears Canada is another example of a department store chain without restaurant and café options, instead focusing on selling merchandise and services.

Although Target‘s recently-shuttered Canadian operations featured licensed Starbucks shops-in-stores, many loyal Zellers shoppers lamented at the loss of Zellers’ in-store restaurants. Although lacking glamour, Zellers’ restaurants acted as destination gathering places, particularly for seniors, adding an element of convenience and socialization to Zellers’ stores.

More recently, Canadian department stores are featuring food options. Nordstrom‘s three Canadian stores, for example, all feature excellent dining options as well as in-store coffee shops. Holt Renfrew is adding restaurants to its stores that currently lack such amenities. Quebec City-based La Maison Simons saw the opening of its first restaurant, SoupeSoup at its new CF Galeries d’Anjou store in the summer of 2013, and a second restaurant opened last month in Simons’ new Park Royal store in West Vancouver. Other new Simons stores will feature similar food experiences.

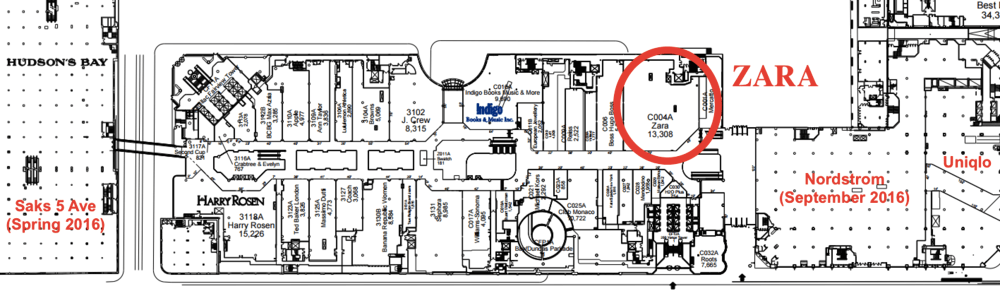

Saks Fifth Avenue is taking the food trend further. In addition to their planned stores incorporating Oliver and Bonacini-operated restaurants, Saks has partnered with Toronto-based Pusateri’s Fine Foods to operate Harrod’s-like food halls in Saks’ Canadian stores. Saks’ first two Canadian stores open in February of 2016 in Toronto.

It’s not just department stores that are adding restaurants in Canada. Vancouver-based fashion brand Kit and Ace, for example, recently opened a 3,300 square foot location at 102 Bloor Street West in Toronto, featuring a coffee concept called Sorry Coffee.

Restaurants keep shoppers in stores longer and can even become destinations, according to Antony Karabus, CEO of leading retail consultancy HRC Advisory. He noted that the department store restaurant phenomenon, particularly popular in European department stores, also has roots in North American retailing. Montreal’s flagship Maison Birks, for example, features Birks Café which Mr. Karabus notes has become a popular destination unto itself. Neiman Marcus‘ downtown Dallas flagship also features a popular restaurant, Zodiac, which is often packed during the lunch hour. The introduction of in-store dining experiences is strategic, Mr. Karabus said, as they keep shoppers in stores longer and more often. He described how shoppers linger in Vancouver’s new flagship Nordstrom store, particularly given the popularity of its Bistro Verde fine dining restaurant and Habitant casual lounge. Mr. Karabus described how in-store restaurants can become destinations unto themselves, and that this additional in-store time will often translate into browsing before or after the meal, likely generating increased retail merchandise sales during that or a later visit.