Before Canada legalized recreational cannabis in October 2018, it was unclear how the change might affect beverage alcohol consumption. Would consumers drink less or more after cannabis became legal?

Drinking might decrease, for example, if people used cannabis in place of alcohol. That switch potentially could reduce alcohol-related harms. But economically, it would mean any gains in the cannabis industry would likely come at the expense of alcohol producers.

Conversely, drinking might increase if people used alcohol along with cannabis. That could boost alcohol industry profits and government tax revenues, but at the cost of increased health risks of both substances.

In response to this uncertainty, some businesses diversified. One alcohol producer bought a cannabis grower, while a cannabis firm took took over several beer brewers.

Research from the United States into the relationship between alcohol and cannabis use is inconclusive. Some studies report that alcohol use decreased in states that allowed cannabis, while others said usage increased or didn’t significantly change. Those conflicting conclusions might reflect the complex legal situation in the United States, where cannabis remains illegal under federal law, even in states that allow its use.

In Canada, some studies indicate alcohol consumption declined slightly as medical cannabis use became more common. Did similar decreases follow recreational legalization?

To investigate this question, I first collaborated with health science researchers Daniel Myran, Robert Talarico, Jennifer Xiao and Rachael MacDonald-Spracklin to study Canada’s overall alcohol sales.

Total sales looked stable

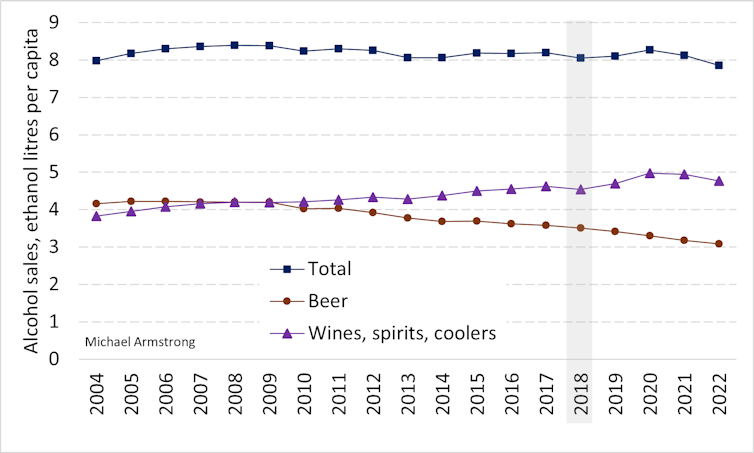

We started our research by examining annual alcohol sales from 2004 to 2022. During that period, beer sales gradually fell, while the sale of coolers and other drinks steadily rose. That left total sales basically unchanged.

So consumers were apparently switching from beer to other beverages. But there were no obvious effects from 2018’s cannabis legalization.

We also compared monthly sales during the 12 months before legalization versus the 12 after. This included national average sales by liquor retailers and beer producers. In both cases, sales trends showed no significant changes in October 2018.

However, this research on Canada-wide sales was mainly designed to detect large changes. To find subtler ones, I focused on the province of Nova Scotia.

Some liquor stores sold cannabis

When Canada legalized cannabis, most provinces banned liquor stores from selling it to avoid tempting alcohol drinkers into trying cannabis.

Nova Scotia did the opposite. Its government-owned liquor corporation became the main cannabis retailer. After legalization in October 2018, most provincial liquor stores kept selling only alcohol, but some began selling cannabis as well.

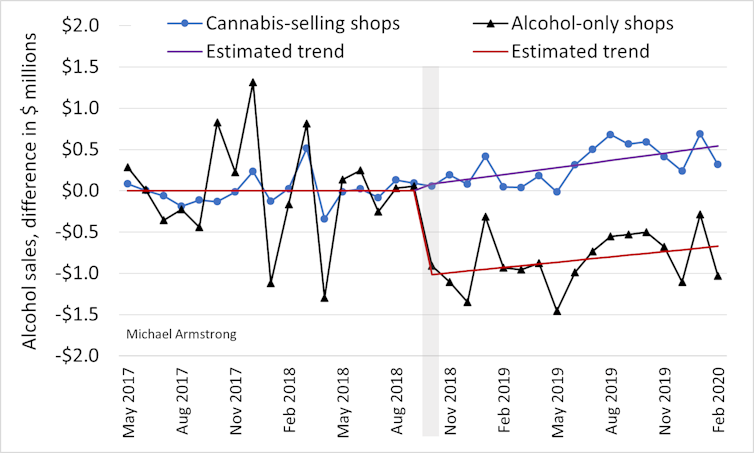

This unique situation prompted me to study the province’s sales. I focused on the 17 months before and 17 months after legalization.

The corporation’s total alcohol sales initially fell in October 2018, then slowly regrew. As a result, monthly sales after legalization averaged about $500,000 below their earlier levels.

More interestingly, the changes differed between the cannabis-selling stores and the alcohol-only ones. At the alcohol-only stores, sales immediately fell. They averaged $800,000 below previous levels.

But at cannabis-sellers, alcohol sales began growing. Total monthly sales from October 2018 to February 2020 averaged $300,000 above earlier levels.

The divergence in sales was larger for beers than for spirits or wines.

Interestingly, alcohol-only stores located near cannabis-selling stores had changes similar to those located farther away, suggesting that cannabis-seller proximity didn’t matter.

Switching substances or stores?

My data can’t say why the sales split occurred, but I can speculate.

Consider the immediate sales drop at alcohol-only stores — this could suggest some consumers switched from alcohol to cannabis right after legalization.

Meanwhile, the lack of a drop at cannabis sellers might mean some consumers simply changed where they shopped. Instead of visiting their local alcohol-only retailer, they went to cannabis sellers to shop for alcohol and cannabis together.

The cannabis sellers’ ongoing growth might reflect people increasingly buying cannabis from licensed stores instead of illegal dealers. They went to those stores to buy weed, but picked up some extra booze while they were there.

Looking ahead

My research so far has focused on the initial post-legalization period, from October 2018 to February 2020.

I plan to study later periods next, when cannabis retailing was more widespread and perhaps more influential.

That will be more challenging, however, because COVID-19 arrived in March 2020. The pandemic disrupted sales of alcohol, though not of cannabis. It will be tricky to separate cannabis effects from pandemic ones, or from Canadian consumers’ evolving drinking habits in general.

My guess is that cannabis legalization had little short-term impact on existing drinkers overall. Most Canadians didn’t suddenly consume cannabis with their cabernet or replace vodka with vapes.

Instead, we might see gradual long-term shifts. Young Canadians now reach legal age in a context where cannabis and alcohol are both allowed. Some folks who previously would have started drinking alcohol might now choose cannabis instead, or in addition.

For now, alcohol drinking is still three times more common than cannabis use. Whether that continues, only time will tell.

About the Author: Michael J. Armstrong is an Associate Professor, Operations Research, at Brock University.

This article originally appeared in The Conversation.